Table of Contents

- 2024 - Maximum TSP/401k and IRA contributions - YouTube

- IRS increases 401(k), other 2025 retirement plan contribution limits ...

- TFSA Contribution Limit 2024

- Tfsa Contribution Limit 2024 - Bree Marley

- TFSA Contribution Limit 2024

- Maximum 401k Employee Contribution 2024 - Venus Jeannine

- A Guide to the 2024 Tax Free Saving Account (TFSA) – Advantage Wealth ...

- Tax Rules 2024 - Lilla Patrice

- A Guide to the 2024 Tax Free Saving Account (TFSA) – Advantage Wealth ...

- Here's the Latest 401k, IRA and Other Contribution Limits for 2024

Introduction to 401(k) Plans

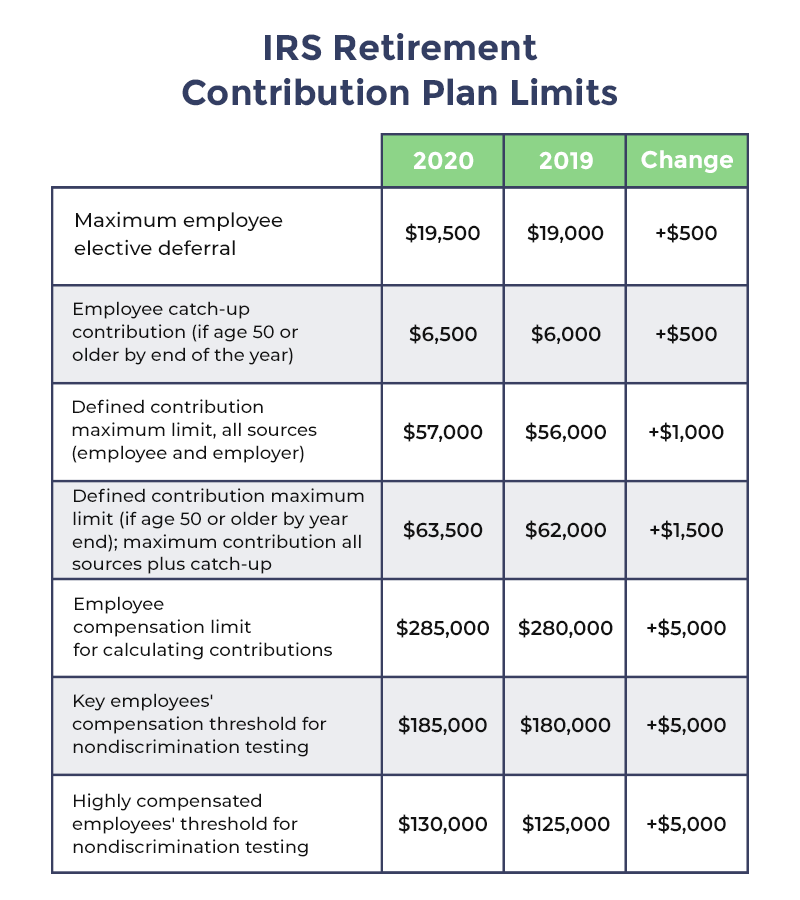

Historical 401(k) Contribution Limits

Catch-Up Contributions

In addition to the standard contribution limits, the IRS also allows for catch-up contributions for individuals aged 50 and above. These contributions, which were introduced in 2002, enable older workers to save more for their retirement. The catch-up contribution limit has also increased over the years, from $1,000 in 2002 to $6,500 in 2022.

Impact on Retirement Savings

The evolution of 401(k) contribution limits has had a significant impact on retirement savings in the United States. By allowing individuals to contribute more to their retirement accounts, the increased limits have enabled people to build larger nest eggs and better prepare for their golden years. According to DQYDJ, the average 401(k) balance has grown significantly over the years, with some individuals accumulating balances in excess of $1 million. In conclusion, the historical 401(k) limits have undergone significant changes since the plan's introduction in 1978. From the initial contribution limit of $1,500 to the projected limit of $22,500 in 2025, the increases have enabled individuals to save more for their retirement. As the contribution limits continue to evolve, it's essential for individuals to stay informed and take advantage of the opportunities available to them. By doing so, they can build a more secure financial future and enjoy a comfortable retirement.Source: DQYDJ

Note: The projected contribution limit for 2025 is based on historical trends and may be subject to change. It's essential to consult with a financial advisor or the IRS for the most up-to-date information on 401(k) contribution limits.